Private Real Estate

Income‑producing real estate focused on durable cash flow and disciplined value creation.

Private Real Estate

Income‑producing real estate focused on durable cash flow and disciplined value creation.

Investment Strategy

Investment Strategy

We look for well‑located, cash‑flowing properties in markets with strong demographic and employment trends.

Focused on Capital Preservation

Conservative leverage (typically fixed loans at 60-70% LTV), thorough due diligence, and focus on middle-market properties, in regions with strong demographic tailwinds help protect downside while maximizing upside potential.

Value-Add Projects

We target properties with strong operational history that also have potential upside through strategic renovations, improved property management, and repositioning to capture rent growth in expanding markets.

Income + Appreciation

Our strategy balances regular cash flow payments with long-term capital appreciation, through a combination of rental income and property value growth.

Active Asset Management

We partner and co-invest with best-in-class local operators who provide hands-on management, ensuring our properties are optimized for performance throughout the hold period.

Asset Classes

Asset Classes

We focus on a select set of recession‑resilient asset classes where we see durable demand and clear opportunities for value creation.

We focus on a select set of recession‑resilient asset classes where we see durable demand and clear opportunities for value creation.

Multifamily

We invest in middle‑market multifamily communities that serve everyday renters, with stable operations and potential for value-add.

Class B communities that sit between luxury Class A and distressed Class D, targeting durable, middle‑income renter demand.

Middle‑market deal sizes that are below the radar of large institutional buyers, where pricing is more attractive.

Markets with diversified, resilient local economies to reduce cash‑flow volatility through cycles.

Operationally sound assets with clear value‑add potential, where targeted CapEx can drive NOI growth.

We invest in middle‑market multifamily communities that serve everyday renters, with stable operations and potential for value-add.

Class B communities that sit between luxury Class A and distressed Class D, targeting durable, middle‑income renter demand.

Middle‑market deal sizes that are below the radar of large institutional buyers, where pricing is more attractive.

Markets with diversified, resilient local economies to reduce cash‑flow volatility through cycles.

Operationally sound assets with clear value‑add potential, where targeted CapEx can drive NOI growth.

Student Housing

We look for student housing near universities that deliver great education at affordable prices.

Focus on universities that deliver excellent value for money.

Properties near universities with growing enrollment and limited on‑campus housing.

Assets with operational upside where improved management, marketing, and selective CapEx can enhance pre‑leasing velocity, occupancy, and rent per bed.

We look for student housing near universities that deliver great education at affordable prices.

Focus on universities that deliver excellent value for money.

Properties near universities with growing enrollment and limited on‑campus housing.

Assets with operational upside where improved management, marketing, and selective CapEx can enhance pre‑leasing velocity, occupancy, and rent per bed.

Our Portfolio

Our Portfolio

An active portfolio built atop our investment thesis and research

An active portfolio built atop our investment thesis and research

First, we identify high-growth markets with positive net migration and resilient economies. Then, we look for properties with strong fundamentals that are ready for extra value-add through active management.

First, we identify high-growth markets with positive net migration and resilient economies. Then, we look for properties with strong fundamentals that are ready for extra value-add through active management.

4

4

States

7

7

Markets

12

12

Active Properties

Properties

Active Properties

The properties behind our current strategy

Multifamily

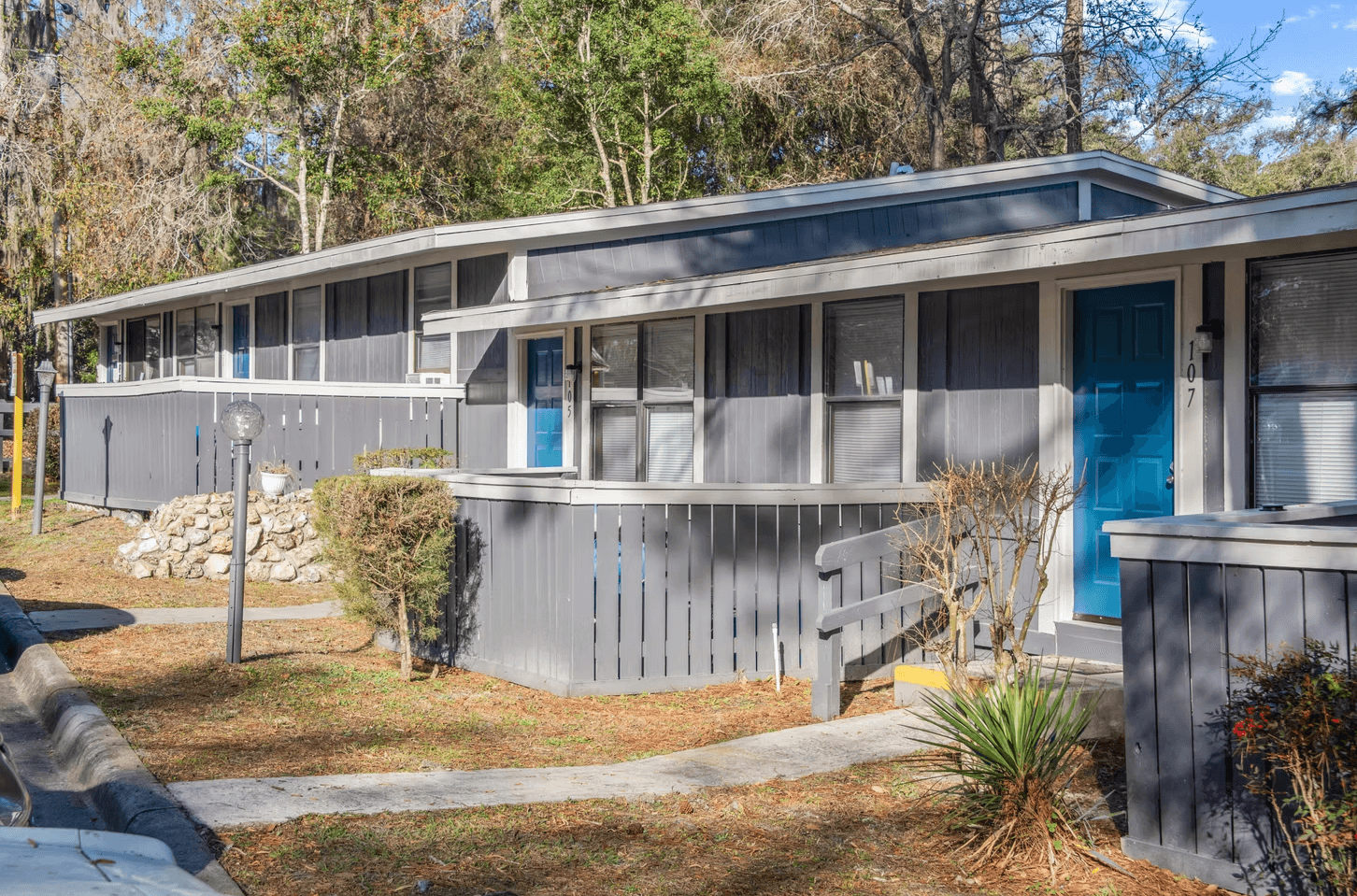

North Pointe Villas

Acquired Q4 2019

Gainesville, FL

66 Units

Multifamily

Multifamily

North Pointe Villas

Acquired Q4 2019

Gainesville, FL

66 Units

Multifamily

Multifamily

Castle Apartments

Acquired Q4 2020

Tallahassee, FL

120 Units

Multifamily

Multifamily

Castle Apartments

Acquired Q4 2020

Tallahassee, FL

120 Units

Multifamily

Multifamily

Mill Run Apartments

Acquired Q2 2021

Gainesville, FL

36 Units

Multifamily

Multifamily

Mill Run Apartments

Acquired Q2 2021

Gainesville, FL

36 Units

Multifamily

Student

Seminole Trails

Acquired Q1 2021

Tallahassee, FL

318 Beds

Student

Student

Seminole Trails

Acquired Q1 2021

Tallahassee, FL

318 Beds

Student

Multifamily

The Pines Apartments

Acquired Q2 2022

Tallahassee, FL

96 Units

Multifamily

Multifamily

The Pines Apartments

Acquired Q2 2022

Tallahassee, FL

96 Units

Multifamily

Student

Vertex Apartments

Acquired Q4 2022

Tallahassee, FL

310 Beds

Student

Student

Vertex Apartments

Acquired Q4 2022

Tallahassee, FL

310 Beds

Student

Multifamily

Amberwood Hills

Acquired Q4 2022

Lake City, FL

101 Units

Multifamily

Multifamily

Amberwood Hills

Acquired Q4 2022

Lake City, FL

101 Units

Multifamily

Multifamily

ABQ Encore and Uptown

Acquired Q4 2022

Albuquerque, NM

208 Units

Multifamily

Multifamily

ABQ Encore and Uptown

Acquired Q4 2022

Albuquerque, NM

208 Units

Multifamily

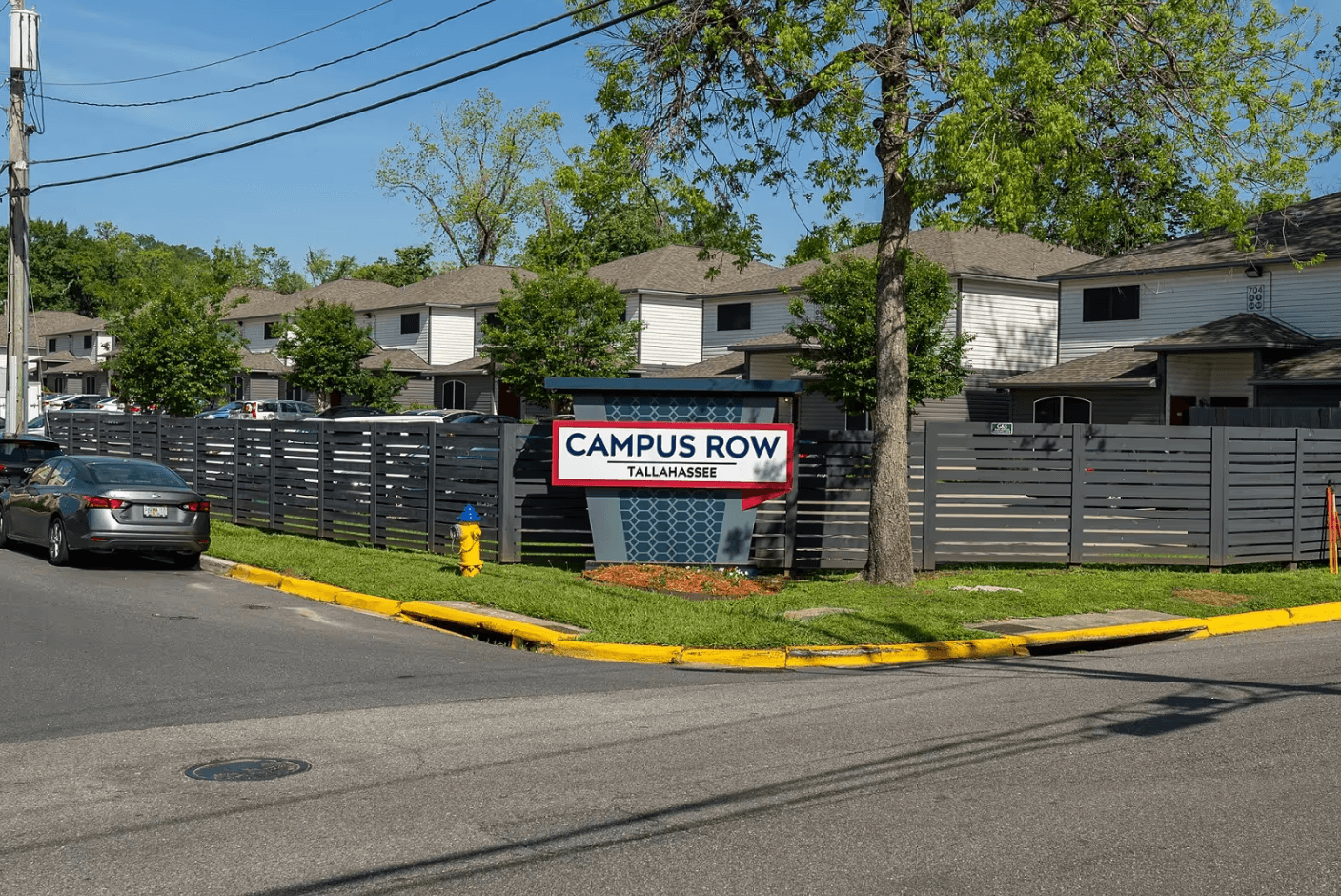

Student

Campus Row

Acquired Q1 2023

Tallahassee, FL

180 Beds

Student

Student

Campus Row

Acquired Q1 2023

Tallahassee, FL

180 Beds

Student

Student

Stadium View

Acquired Q2 2024

College Station, TX

216 Beds

Student

Student

Stadium View

Acquired Q2 2024

College Station, TX

216 Beds

Student

Student

University Edge

Acquired Q4 2024

Waco, TX

236 Beds

Student

Student

University Edge

Acquired Q4 2024

Waco, TX

236 Beds

Student

Student

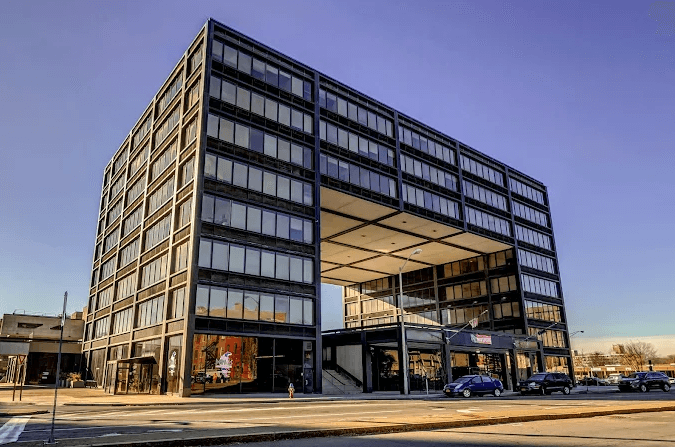

20 Hawley

Acquired Q3 2025

Binghamton, NY

290 Beds

Student

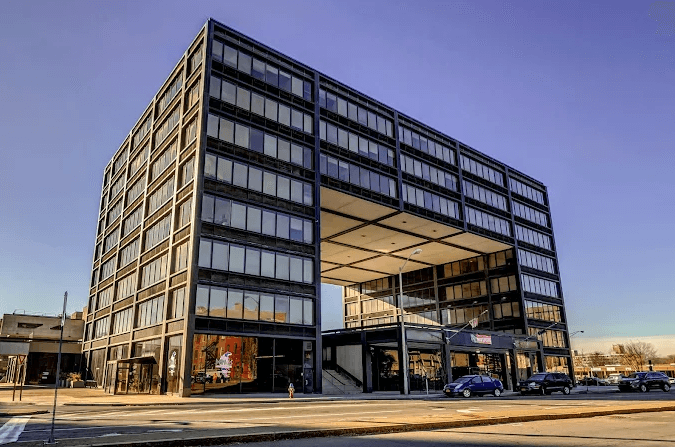

Student

20 Hawley

Acquired Q3 2025

Binghamton, NY

290 Beds

Student

Ready to invest?

Partner with VO2 Alternatives Team to access institutional-grade real estate and private credit opportunities in the US market.

Start a Conversation

Ready to invest?

Partner with VO2 Alternatives Team to access institutional-grade real estate and private credit opportunities in the US market.

Start a Conversation

Contact Us

Contact Us

Contact Us

Important information

Investments in private real estate and private credit offered are speculative, illiquid and involve a high degree of risk, including the possible loss of your entire investment. They are intended only for qualified investors who can bear such risks over a long-term investment horizon and may not be suitable for all investors.

Nothing on this website constitutes investment, legal or tax advice, or a recommendation to buy or sell any security, and past performance is not indicative of future results.

Important information

Investments in private real estate and private credit offered are speculative, illiquid and involve a high degree of risk, including the possible loss of your entire investment. They are intended only for qualified investors who can bear such risks over a long-term investment horizon and may not be suitable for all investors.

Nothing on this website constitutes investment, legal or tax advice, or a recommendation to buy or sell any security, and past performance is not indicative of future results.

Important information

Investments in private real estate and private credit offered are speculative, illiquid and involve a high degree of risk, including the possible loss of your entire investment. They are intended only for qualified investors who can bear such risks over a long-term investment horizon and may not be suitable for all investors.

Nothing on this website constitutes investment, legal or tax advice, or a recommendation to buy or sell any security, and past performance is not indicative of future results.